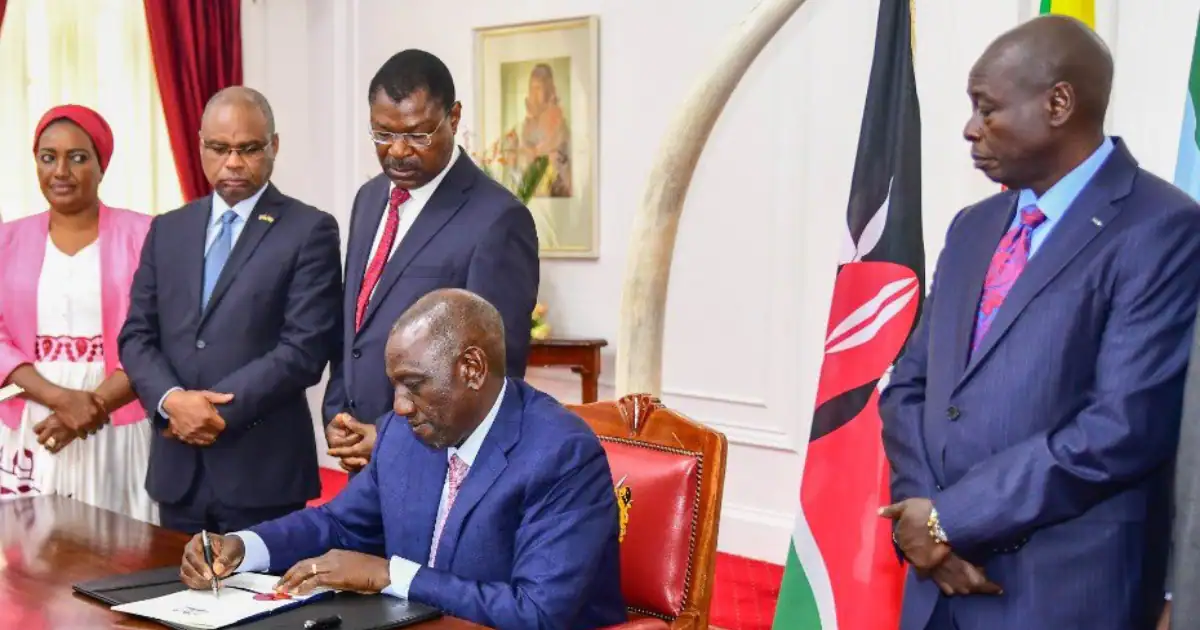

President William Ruto is facing mounting pressure to generate revenue for the 2023/24 Budget, particularly with the Finance Act, 2023 hanging in the balance.

An IMF staff country report reveals that the National Treasury is preparing to introduce additional taxes on Kenyans, only months after facing heavy criticism for pushing through the Finance Act, 2023.

One of the proposed taxes is the motor vehicle circulation tax, which is expected to encounter strong resistance from players in the automobile industry. This tax may include toll station fees and taxes based on engine size, weight, and age of the vehicle.

The government is also considering cutting down on spending for non-essential items if the situation demands it.

The new tax measures are projected to be introduced in October during the tabling of the supplementary budget.

On a positive note, the government is also contemplating reducing tax exemptions on interest income, aiming to boost investments and encourage savings.

The IMF quoted the Treasury, saying, "Should the approved 2023 Finance Bill result in a weakening of the revenue package (1.6 per cent of GDP) underpinning the Budget proposal and/or FY2022/23 tax underperformance be larger than anticipated at the time of the submission of Supplementary II FY2022/23 Budget we will take a number of corrective tax measures."

These measures may include streamlining the VAT apportionment ratio of allowable inputs VAT on exempt supplies to align it with international practices and reducing VAT exemptions by the end of July 2023.

However, the fate of the Finance Act 2023 remains uncertain after its suspension by the High Court, pending a hearing and determination of the matter. The suspension followed a petition filed by Busia Senator Okiya Omtatah challenging various tax proposals in the Act.

Some of the contentious proposals in the Finance Act 2023 included an increase in fuel tax from 8 per cent to 16 per cent and the introduction of a 1.5 Housing Fund tax, among others.

The revelation of the government's plan to impose more taxes has sparked uproar, with Azimio la Umoja calling on Kenyans to voice their dissent in the ongoing anti-government protests.

"We have stood as one against the Finance Bill. Kenya Kwanza now plans to raise VAT as punishment. Let's show our strength in even greater numbers today. We won't let their VAT increase plan see the light of day," Azimio stated.

The Treasury presented these proposals to the IMF when seeking a Ksh142 billion loan, which has since been approved by the Bretton Wood institution.